accumulated earnings tax calculation

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

Earnings Stripping Effective Tax Strategy To Repatriate Earnings In A Global Economy

Since the accumulated earnings tax is 20 of the accumulated earnings tax base it is 1 st necessary to determine that amount.

. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. A company must be careful to justify the amount of its accumulated retained earnings since some governments tax an excessive amount of these accumulated earnings. Keep in mind that this is not a self-imposed tax.

The accumulated earnings tax will take effect if a firm decides to keep its profits or earnings instead of distributing dividends to shareholders and the amount of retained earnings. The formula for calculating the working capital needs of a manufacturing concern or similar business is set forth in the. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

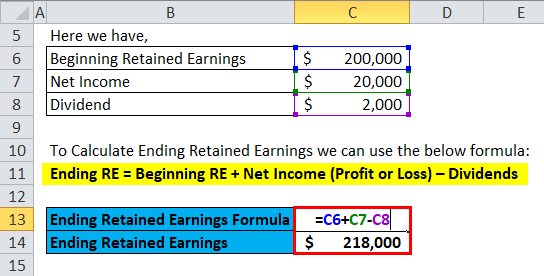

Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. The formula for calculating retained earnings RE is. The regular corporate income tax.

However if a corporation allows earnings to accumulate. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. C corporations can earn up to 250000 without incurring accumulated.

Accumulated earnings and profits are a companys net profits. RE Initial RE net income dividends. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

An IRS review of a business can impose it. The tax is in addition to the regular corporate income tax and is. Calculating the Accumulated Earnings Tax.

Corporation has a book net income of 20 million 500000 of book depreciation 1 million of tax depreciation 500000 of earnings and profits. Recently the Tax Court had an opportunity to consider the. Suppose that a US.

The Financial Accounting Standards Board FASB issued a new standard in 1997 requiring a comprehensive accounting of all income including other or special types of. IRM 48821 Accumulated Earnings Tax. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. For example lets assume a certain. The tax is assessed at the highest individual tax rate.

It compensates for taxes which. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. Calculating the Accumulated Earnings.

Retained Earnings Formula And Calculator

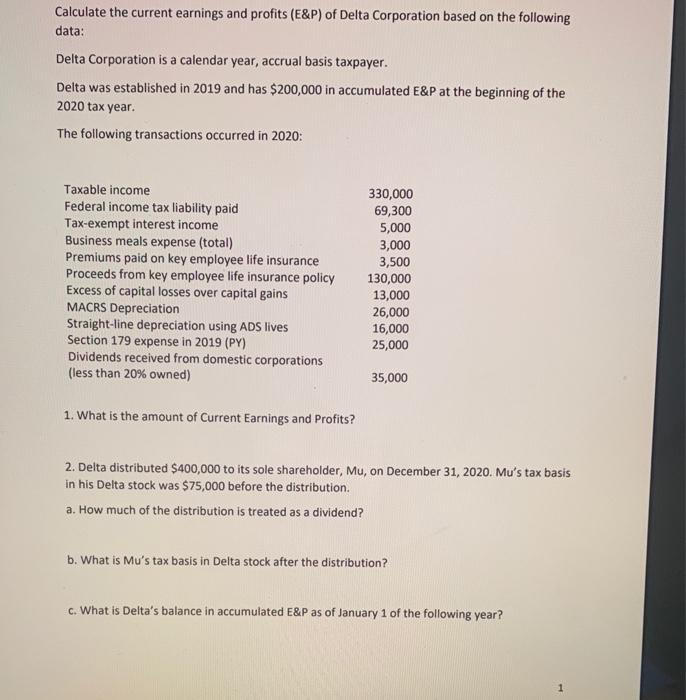

Earnings And Profits Computation Case Study

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

Effective Tax Rate Formula And Calculator Step By Step

Retained Earnings Formula Calculator Excel Template

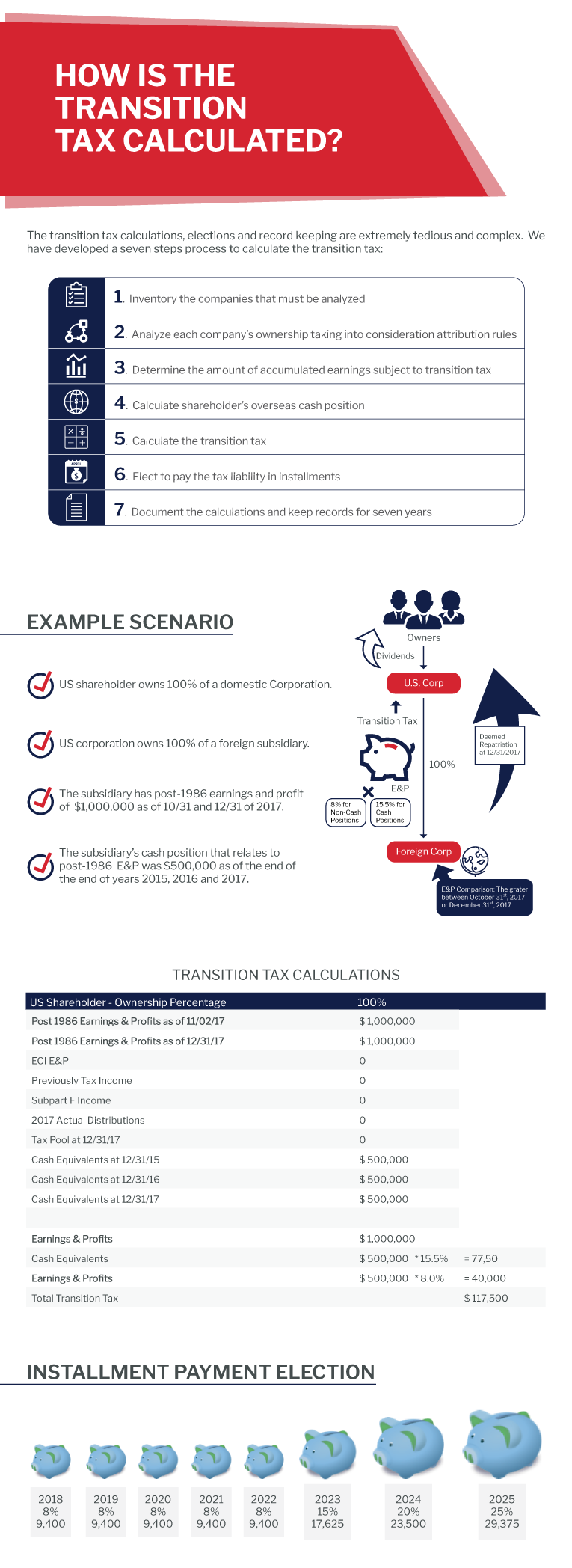

Transition Tax Calculations H Co

Calculating An S Corporation S Separately Stated Items For Federal Income Tax Purposes Video Lesson Transcript Study Com

Demystifying Irc Section 965 Math The Cpa Journal

Corporate Tax In The United States Wikipedia

Demystifying Irc Section 965 Math The Cpa Journal

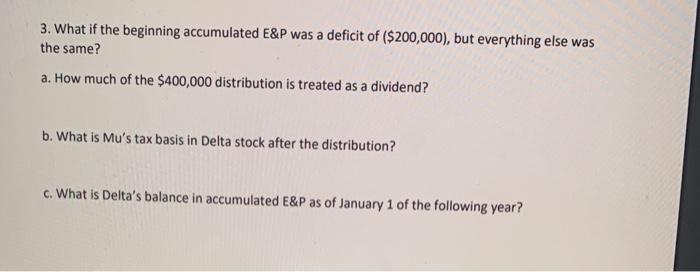

Solved Calculate The Current Earnings And Profits E P Of Chegg Com

Accumulated Earnings And Profits How To Calculate Accumulated Earnings Youtube

Retained Earnings In Accounting And What They Can Tell You

Double Taxation Of Corporate Income In The United States And The Oecd

Demystifying Irc Section 965 Math The Cpa Journal

Solved Calculate The Current Earnings And Profits E P Of Chegg Com

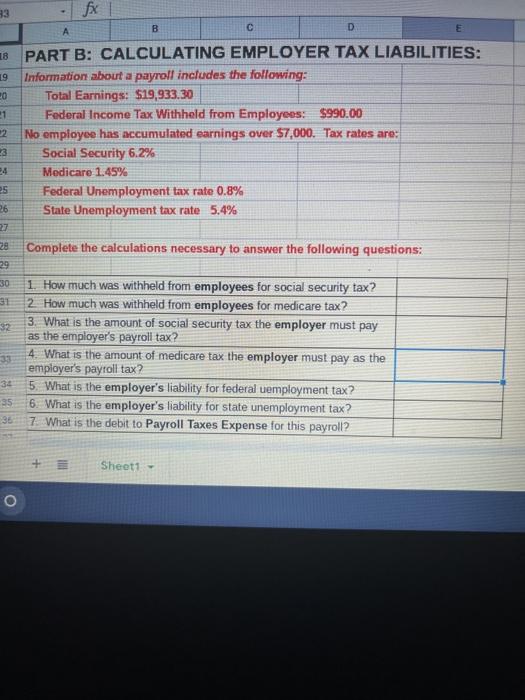

Solved 83 A B D 19 21 18 Part B Calculating Employer Tax Chegg Com

Accumulated Earnings And Profits How To Calculate Accumulated Earnings Youtube